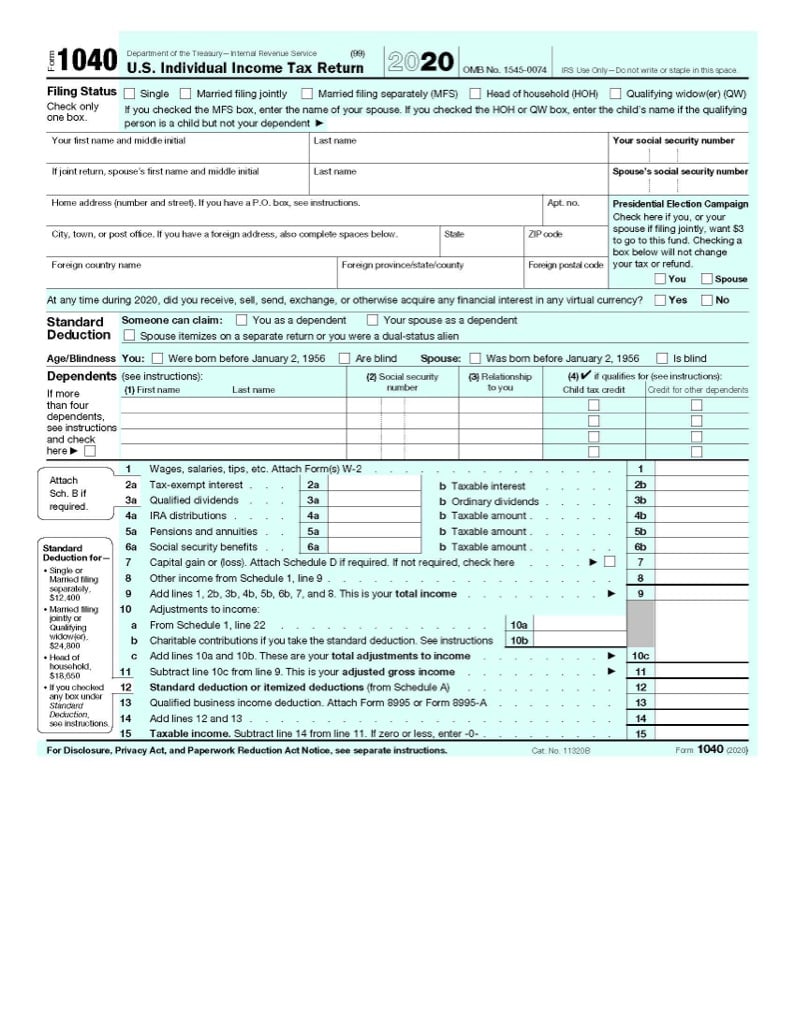

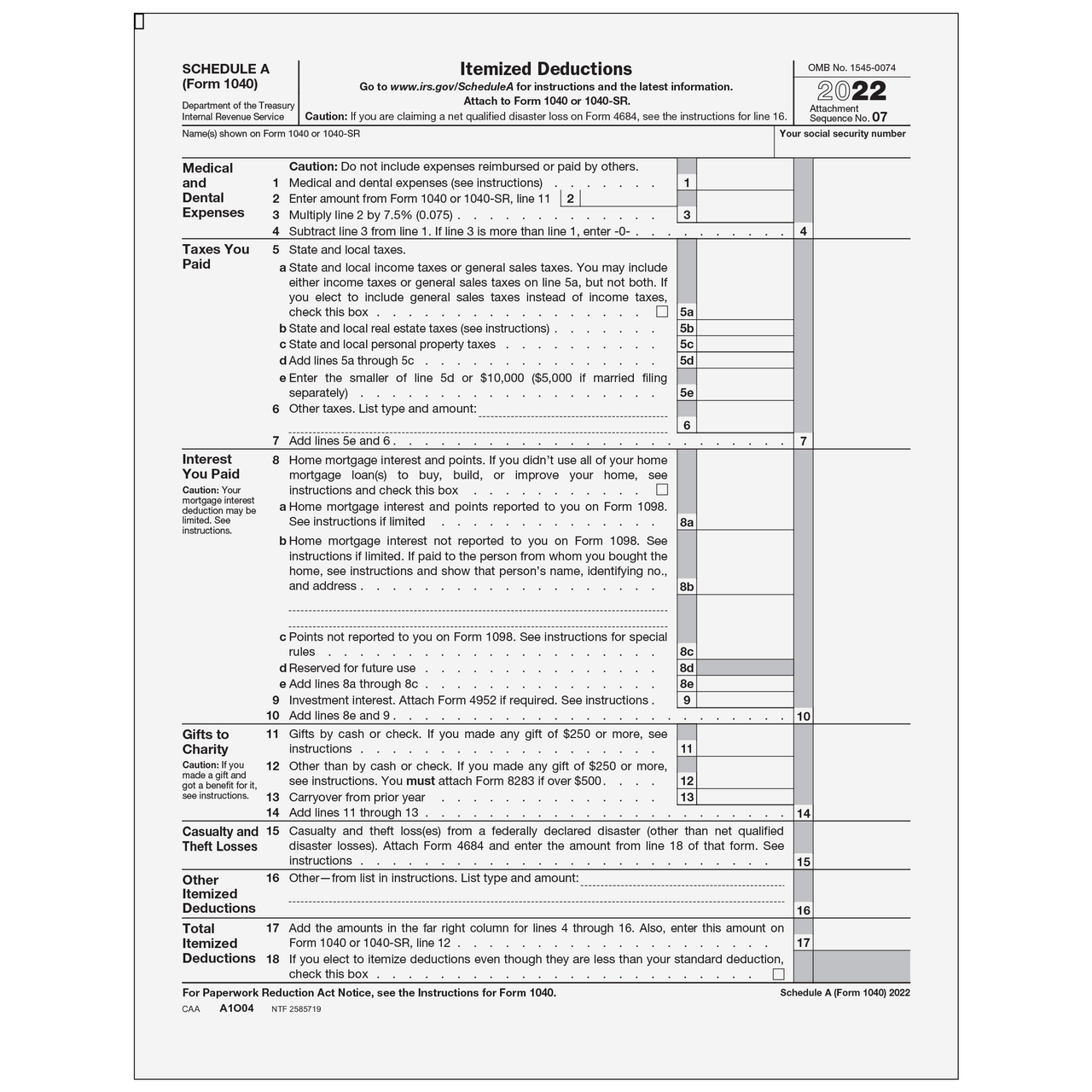

Irs Schedule A 2024 Itemized Deductions – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. .

Irs Schedule A 2024 Itemized Deductions

Source : www.investopedia.comItemized Deductions & Schedule A (Form 1040) Jackson Hewitt

Source : www.jacksonhewitt.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com2024 Form W 4P

Source : www.irs.govIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comA1O04 Form 1040 Schedule A Itemized Deductions Greatland.com

Source : www.greatland.comWhat Is Schedule A of Form 1040?

Source : www.thebalancemoney.comSchedule A (Form 1040) Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIrs Schedule A 2024 Itemized Deductions All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2024. . Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-e2490b265c7e42d1b79c9d70835003fd.png)